Establish Your Legacy

The Bradley Impact Fund empowers members to create enduring philanthropic legacies that honor their donor intent. Our members support organizations with powerful ideas and strategic missions in their local communities and nationally.

Working with each Legacy Society member, the Impact Fund helps craft customized philanthropic legacy plans that safeguard giving and support organizations whose leadership effectively implements the ideas and programs that matter most to you. Unlike organizations that view donor intent as just one of many priorities, we place it at the center of our mission. Through a partnership with the Bradley Impact Fund, Legacy Society members gain confidence that their philanthropic vision will be faithfully stewarded according to their wishes, even beyond their lifetime.

Schedule a conversation with an Impact Fund team member to learn more.

The Bradley Impact Legacy Society welcomes philanthropists who commit to entrusting the Impact Fund with stewarding their charitable intentions beyond their lifetime. The Society honors members' dedication to partnering with the Impact Fund to preserve their donor intent now and for future generations.

The primary benefit of Legacy Society membership is peace of mind—knowing the Impact Fund will ensure your philanthropic legacy supports only the ideas, principles, and institutions you believe in.

To honor each member's commitment, the Impact Fund facilitates legacy gifts of both traditional and non-traditional assets, while providing philanthropic advisory services. Members also receive invitations to exclusive events.

Frequently Asked Questions

+-

How can my Bradley Impact Fund DAF be included in my estate plan?

The Bradley Impact Fund provides personalized guidance on protecting your intent when naming your Bradley Impact Fund DAF as a beneficiary in your estate plan, including in wills, trusts, IRAs, life insurance policies, and other vehicles.

+-

What types of assets are accepted for legacy gifts to the Bradley Impact Fund DAF?

The Bradley Impact Fund accepts a wide range of assets for contributions to your DAF, including cash, appreciated stocks, real estate, private investments, retirement assets, and life insurance policies, both during your lifetime and with estate gifts. View types of assets accepted.

+-

Is there a minimum amount required for a bequest to a Bradley Impact Fund DAF?

Please contact the Bradley Impact Fund directly for information about minimum bequest amounts. Our team will provide personalized guidance based on your specific situation and philanthropic goals.

+-

What are the tax benefits of leaving assets to my Bradley Impact Fund DAF in my estate?

Charitable bequests to your Bradley Impact Fund DAF can potentially reduce or eliminate estate taxes. Leaving retirement assets to your DAF can also help reduce income taxes for your heirs. We encourage all donors to consult their tax and legal advisors about the advantages of making a charitable gift into a DAF account with the Bradley Impact Fund and incorporating that account into their estate plan.

+-

Can I name my children or other individuals as successors to my Bradley Impact Fund DAF?

Yes, the Bradley Impact Fund lets you name successor advisors to manage your DAF and recommend grants to charities after your passing, ensuring your philanthropic vision continues for generations.

.

+-

Can I advise on which charities should receive the remaining funds in my Bradley Impact Fund DAF after my death?

Yes, you have the option to recommend which specific charitable beneficiaries should receive the remaining funds in your Bradley Impact Fund DAF upon your death, honoring your philanthropic intentions.

+-

What happens to the funds in my Bradley Impact Fund DAF if I don't have a succession plan?

In the absence of a succession plan, the funds remaining in your Bradley Impact Fund DAF will be granted to organizations aligned with the Bradley Impact Fund's charitable mission and guiding principles.

+-

How are the funds of my Bradley Impact Fund DAF invested upon my passing?

You may select from a range of investment options including an individually-managed account to best match the intent and timeline for your legacy gift including. Investments may be reallocated after your passing to align with your intended gifting timeline.

+-

What are the fees on a legacy gift?

Bradley Impact Fund charges a low, one-time management fee at the time of contribution being allocated to the donor-advised account in addition to any direct costs of gift acceptance. The proceeds of legacy gifts are granted according to your stated timeline and intent without any ongoing administrative or management fees.

The Bradley Legacy

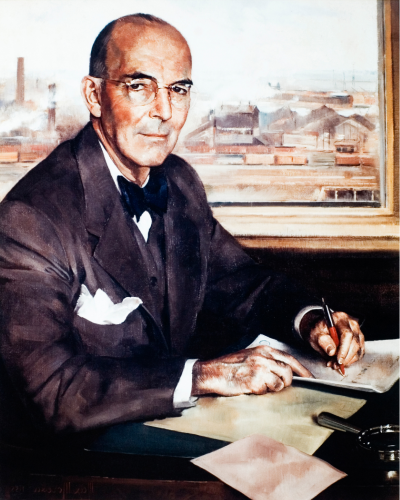

Lynde and Harry Bradley, Their Company, and Their Foundation

Published in 1992, the book originated from Sarah Doll Barder's vision. As a board member of The Lynde and Harry Bradley Foundation and Lynde Bradley's niece, she worried that following the 1985 Allen-Bradley Company sale and foundation separation, the organization might lose touch with its founders' core principles.

Donor Intent is in Our DNA

Founded in 2013, the Bradley Impact Fund is a donor-advised fund with a mission to serve as philanthropic advisors who educate, empower, and inspire donors to advance our common principles through high-impact giving and the protection of donor intent. Aligned with The Lynde and Harry Bradley Foundation—which has granted over $1 billion since 1985 to protect America's founding principles—the Impact Fund offers professional service and expertise to like-minded philanthropists seeking a vehicle for their own informed, impactful grant-making.

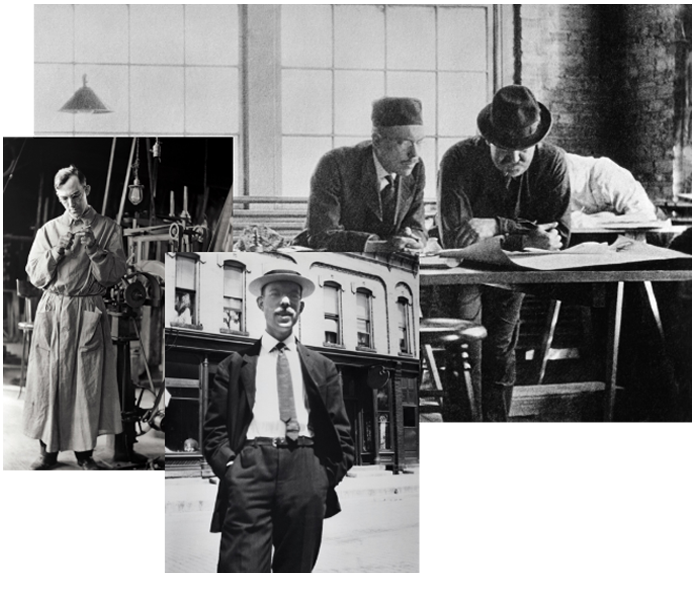

The Bradley Foundation originated from Lynde and Harry Bradley's entrepreneurial vision. In 1903, Lynde invented the compression rheostat and launched Allen-Bradley Company with Dr. Stanton Allen's $1,000 investment. His brother Harry joined the company in 1904. Hired in 1910, Fred Loock became known as the "third founder" serving as president from 1947-1967. Over eight decades, Allen-Bradley grew into an internationally acclaimed electronics manufacturer.

The Bradley brothers championed human dignity and valued individuals who developed grit through hard work and education—values shared by Fred Loock and his wife Margaret. Together, they fostered vibrant community life while advocating for freedom and free enterprise.

When Allen-Bradley sold to Rockwell International for $1.65 billion in 1985, with a portion of the proceeds going to the Bradley Foundation—sole beneficiary of the Margaret Loock Trust—the Foundation saw its assets surge from under $14 million to over $290 million overnight. Guided by thoughtful, strategic philanthropy—a hallmark from inception to present—the Foundation expanded nationally while maintaining its Milwaukee commitment, preserving America's founding principles which the Bradley brothers credited for their success and for giving the United States the strongest economy, highest living standard, and greatest individual freedom in the world.

Today, the Foundation continues the brothers' legacy, supporting Milwaukee and Wisconsin communities while promoting the ideas that enabled the Bradleys' success—free enterprise, rule of law, limited government, and an informed citizenry.

Click here to learn more about the Bradley brothers, and their philanthropic legacy, The Lynde and Harry Bradley Foundation.

Preserve Your Principles for Generations

Shared Values. Protected Intent. Flexible Solutions.

The Bradley Impact Fund: Your Strategic Partner in Philanthropic Estate Planning

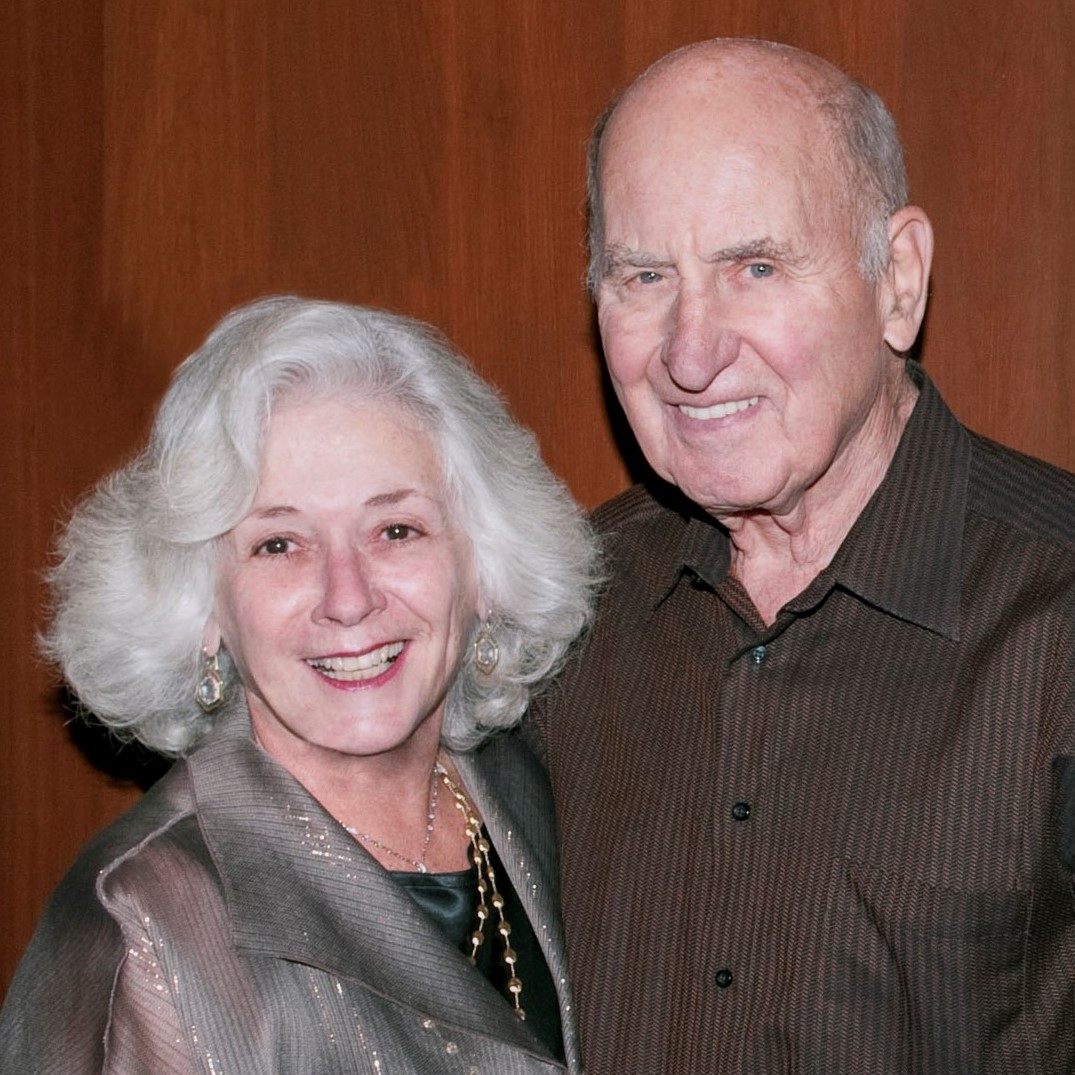

I feel very confident that the Bradley Impact Fund will always follow through with our beliefs. Judy and I rest assured that when we're no longer here our wishes and all our hard earned money will be allocated according to what we believe to be the best interests of our country."

Anthony Maresca

Member, Bradley Impact Fund

You worked hard to make the money, and you’ve got to work hard to make sure you’re investing properly in philanthropy. I think the Bradley Impact Fund can be a major help in this area."

Jack Miller

Member, Bradley Impact Fund

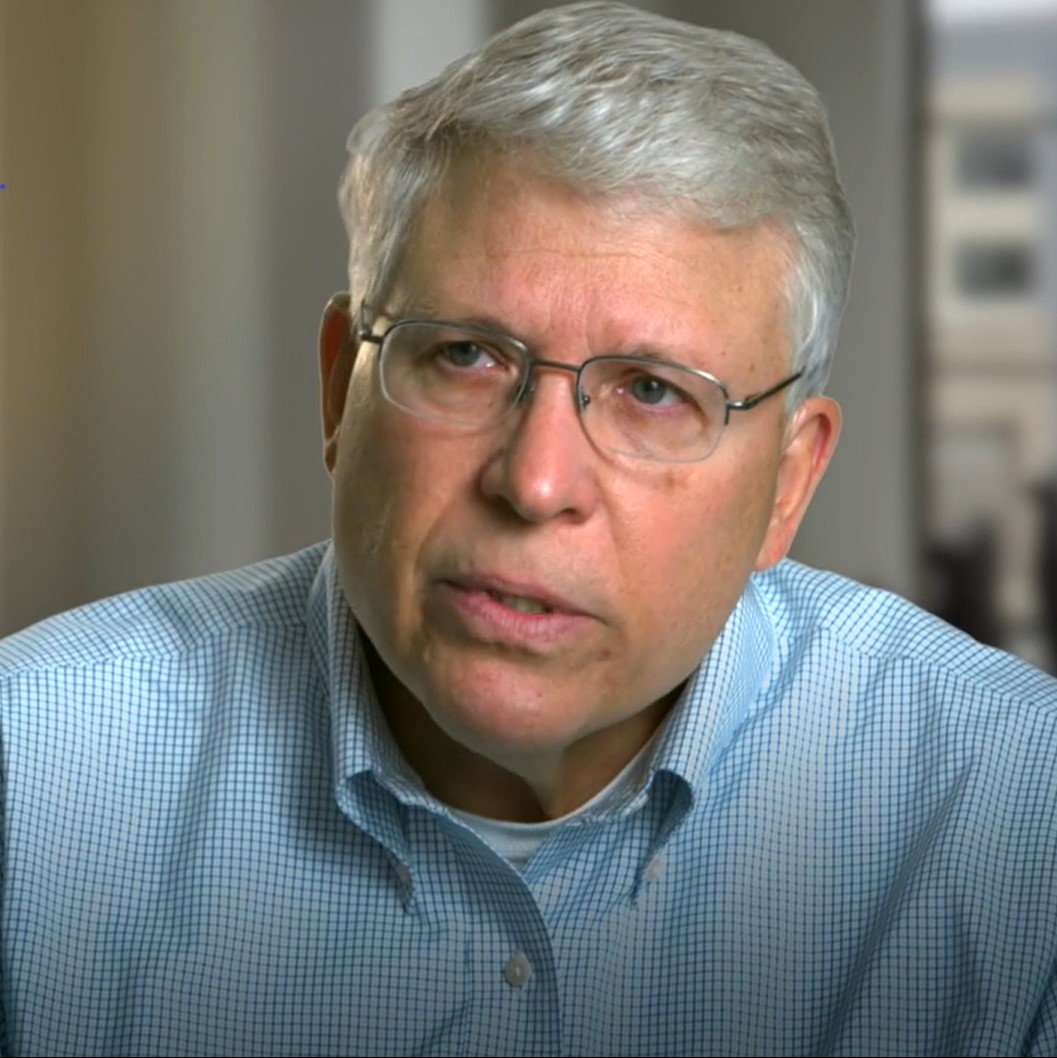

Bradley offers valuable depth of expertise. They know my passions and they make sure my giving supports causes that align with my principles and priorities. I’ve learned a lot from them, and the Impact Fund has changed the way I give for the better."

Patrick English

Member and Director, Bradley Impact Fund

“It is not until a people lose their religion that they lose their religious liberty, not until they cease to speak as free men and women that they lose freedom of speech, not until they permit themselves to be herded into a subservient rabble that they lose their freedom of assembly – and, as business men, not until they begin to rely on outside help, political or otherwise, that they lose their freedom to manage their own establishments.”

- Harry Bradley